Open Your Potential with Professional Loan Services

Open Your Potential with Professional Loan Services

Blog Article

Streamline Your Financial Journey With Trusted and Reliable Finance Solutions

In the realm of personal money, browsing the myriad of funding choices can frequently feel like a difficult task. When furnished with the right tools and advice, the trip towards securing a financing can be streamlined and stress-free. Relied on and effective lending solutions play a critical duty in this process, supplying people a dependable course towards their economic objectives. By comprehending the advantages of dealing with trustworthy lending institutions, checking out the various sorts of loan services readily available, and focusing in on vital aspects that determine the right suitable for your demands, the path to monetary empowerment comes to be clearer. Yet, real significance lies in exactly how these services can be leveraged to not just secure funds however additionally to optimize your financial trajectory.

Benefits of Relied On Lenders

When seeking monetary aid, the benefits of picking trusted lending institutions are vital for a secure and reliable borrowing experience. Relied on lenders use openness in their terms and conditions, giving borrowers with a clear understanding of their commitments. By collaborating with respectable lending institutions, customers can stay clear of hidden charges or predative techniques that could cause economic pitfalls.

Additionally, relied on lenders usually have established connections with governing bodies, ensuring that they operate within legal limits and stick to sector criteria. This conformity not only safeguards the consumer yet also fosters a sense of count on and integrity in the borrowing procedure.

In addition, reputable lenders prioritize customer service, providing support and assistance throughout the borrowing journey. Whether it's clarifying car loan terms or helping with repayment options, trusted lenders are committed to aiding consumers make well-informed economic choices.

Sorts Of Finance Provider Available

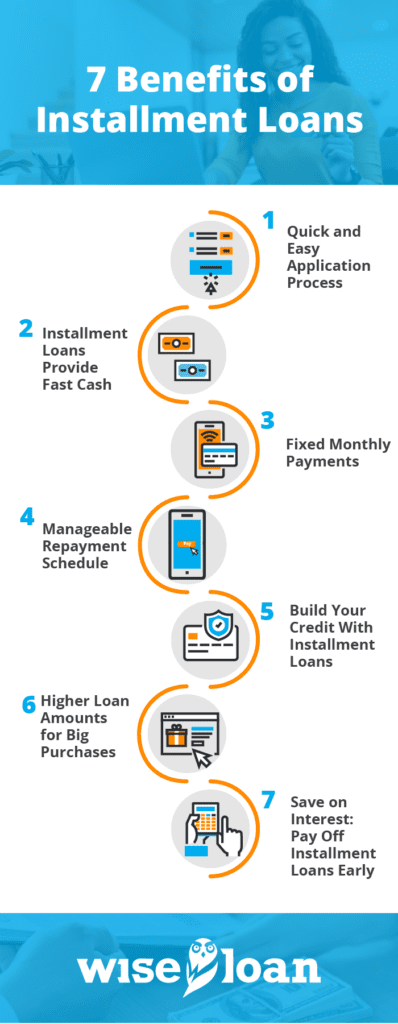

Numerous monetary establishments and borrowing firms use a diverse series of loan solutions to accommodate the varying demands of debtors. A few of the common sorts of funding services available consist of individual fundings, which are usually unsecured and can be made use of for different purposes such as financial debt combination, home renovations, or unforeseen expenses. Home loan are particularly designed to aid individuals acquire homes by supplying substantial quantities of cash upfront that are paid off over an extended duration. For those looking to get a vehicle, auto financings provide a means to finance the acquisition with fixed month-to-month repayments. In addition, company financings are readily available for entrepreneurs looking for funding to begin or broaden their ventures. Student loans cater to instructional expenses, offering funds for tuition, publications, and living expenditures during academic quests. Comprehending the various kinds of funding solutions can help customers make notified choices based upon their details financial requirements and goals.

Elements for Choosing the Right Car Loan

Having familiarized oneself with the varied variety of finance solutions readily available, debtors must meticulously evaluate vital aspects to choose the most appropriate lending for their particular financial demands and purposes. One vital aspect to consider is the rate of interest, as it directly influences the overall amount paid off over the funding term. Customers should contrast passion rates from various loan providers to secure one of the most competitive alternative. Car loan terms and conditions likewise play an important duty in decision-making. Understanding the payment schedule, fees, and fines connected with the lending is vital to prevent any kind of surprises in the future.

Furthermore, consumers should assess their present economic scenario and future prospects to identify the finance quantity they can comfortably afford. By thoroughly thinking about these variables, borrowers can choose the best finance that straightens with their economic objectives and abilities.

Streamlining the Lending Application Process

Efficiency in the funding application process is vital for ensuring a seamless and expedited borrowing experience - merchant cash advance same day funding. To enhance the finance application procedure, it is vital to offer clear assistance to applicants on the called for documents and info. By incorporating these streamlined procedures, finance suppliers can use a much more effective helpful site and easy to use experience to customers, ultimately enhancing overall customer contentment and commitment.

Tips for Effective Finance Payment

Browsing the path to effective lending settlement needs mindful planning and disciplined monetary management. To make sure a smooth repayment trip, beginning by producing a detailed budget plan that includes your loan repayments. Understanding your earnings and expenditures will help you allocate the essential funds for timely repayments. Take into consideration establishing automated settlements to prevent missing out on deadlines and incurring late charges. It's additionally recommended to pay even more than the minimum quantity due each month ideally, as this can aid decrease the total interest paid and shorten the payment duration. Prioritize your funding settlements to avoid defaulting on any type of financings, as this can negatively impact your credit rating and monetary security. In instance of economic difficulties, interact with your loan provider to discover feasible choices such as lending restructuring or deferment. By staying organized, positive, and economically disciplined, you can effectively browse the procedure of settling your finances and attain better economic liberty.

Final Thought

To conclude, utilizing relied on and reliable finance services can significantly streamline your economic journey. By thoroughly picking the appropriate loan provider and kind of lending, and streamlining the application procedure, you can guarantee a successful loaning experience. Keep in mind to focus on prompt repayment to keep monetary stability and construct a favorable credit rating. Trustworthy lending institutions use valuable assistance to help you attain your monetary objectives - Loan Service.

Report this page